Menu

Leveraged / Inverse Products

ChinaAMC NASDAQ-100 Index Daily (2x) Leveraged Product (7261 HK)

Management fee

0.99%(p.a.)

4742

Listing Date

28-Sep-2016

Morningstar

★★★★★ /5

Fund Performance

+4.41%

YTD

+13.34%

1 Year

+162.93%

3 Year

+187.69%

5 Year

+806.86%

Since Inception

As of 27-06-2025

ChinaAMC NASDAQ-100 Index Daily (2x) Leveraged Product (the “Product”) is a leveraged product. It is different from conventional exchange traded funds as it seeks leveraged investment results relative to NASDAQ-100 Index (the “Index”) and only on a daily basis. The Product is not intended for holding longer than one day as the performance of the Product over a longer period may deviate from and be uncorrelated to the leveraged performance of the Index over the period. The Product is designed to be used for short term trading or hedging purposes, and is not intended for long term investment. The Product only targets sophisticated trading-oriented investors who understand the potential consequences of seeking daily leveraged results and the associated risks and constantly monitor the performance of their holdings on a daily basis.

Investment involves risks, including the loss of principle. Past performance is not indicative of future results. The value of the Product can be extremely volatile and could go down substantially within a short period of time. It is possible that the entire value of your investment could be lost. Before investing in the Product, investor should refer to the Product’s prospectus and Product Key Facts Statement for details, including the risk factors. You should not make investment decision based on the information on this material alone. Please note:

• The Product aims to provide daily investment results, before fees and expenses, which closely correspond to the twice (2x) the daily performance of the Index. The Product does not seek to achieve its stated investment objective over a period of time greater than one day.

• The Product is a derivative product and is not suitable for all investors. There is no guarantee of the repayment of principal. Your investment in the Product may suffer substantial or total losses.

• The Product is not intended for holding longer than one day as the performance of the Product over a period longer than one day will very likely differ in amount and possibly direction from the leveraged performance of the Index over that same period (e.g. the loss may be more than twice the fall in the Index).

• Investment in futures contracts involves specific risks such as high volatility, leverage, rollover and margin risks. There may be imperfect correlation between the value of the underlying reference assets and the futures contracts, which may prevent the Product from achieving its investment objective. The Product may be adversely affected by the cost of rolling positions forward as the futures contracts approach expiry. An extremely high degree of leverage is typical of a futures trading account. As a result, a relatively small price movement in a future contract may result in a proportionally high impact and substantial losses to the Product.

• The Product will use leverage to achieve a Daily return equivalent to twice (2x) of the return of the Index. Should the value of the underlying securities of the Index decrease, the use of a leverage factor of 2 in the Product will trigger an accelerated decrease in the value of the Product’s NAV compared to the Index. Both gains and losses will be magnified. Unitholders could, in certain circumstances including a bear market, face minimal or no returns, or may even suffer a complete loss, on such investments.

• There is no assurance that the Product can rebalance its portfolio on a Daily basis to achieve its investment objective. Market disruption, regulatory restrictions or extreme market volatility may adversely affect the Product’s ability to rebalance its portfolio.

• The Product is exposed to liquidity risk linked to the futures contracts. Moreover, the rebalancing activities of the Product typically take place at or around the close of trading on the NASDAQ to minimise tracking difference. As a result, the Product may be more exposed to the market conditions during a shorter interval and may be more subject to liquidity risk.

• The Product is normally rebalanced at or around the close of trading on the NASDAQ. As such, return for investors that invest for period less than a full trading day will generally be greater than or less than two times (2x) leveraged investment exposure to the Index, depending upon the movement of the Index from the end of one trading day until the time of purchase.

• Daily rebalancing of Product’s holdings causes a higher level of portfolio transactions than compared to the conventional exchange traded funds. High levels of transactions increase brokerage and other transaction costs.

• The Product’s investment in equity securities is subject to general market risks.

• The Product is subject to concentration risks as a result of tracking the leveraged performance of companies from the technology sector and its concentration in the US market which may be more volatile than other markets. The value of the Product may be more volatile than that of a broadly-based fund.

• The Product may be subject to tracking error risk. Tracking error may result from the investment strategy used, high portfolio turnover, liquidity of the market and fees and expenses and the correlation between the performance of the Product and the twice (2x) Daily performance of the Index may be reduced. There can be no assurance of exact or identical replication of the twice performance of the Index at any time, including on an intra-day basis.

• Distributions (if any) will be made in USD. If you has no USD account, you may have to bear the fees and charges associated with the conversion of such dividend from USD to HKD or any other currency.

• The Product is passively managed and the Manager will not have the discretion to adapt to market change due to the inherent investment nature of the Product. Falls in the Index are expected to result in falls in the value of the Product.

• The daily price limit for the NASDAQ (which is triggered when the price of the S&P 500 Index drops 20% in a day) and the daily price limit for the futures contracts are different. As such, should the Index’s daily price movement be greater than the price limit of the futures contracts, the Product may not be able to achieve its investment objective as the futures contracts are unable to deliver a return beyond their price limit.

• As the CME may be open when Units in the Product are not priced, the value of the futures contracts in the Product’s portfolio, or the value of constituents in the Index to which such futures contracts are linked, may change on days when investors will not be able to purchase or sell the Product’s Units. Differences in trading hours between the CME and the SEHK may increase the level of premium/discount of the Unit price to its NAV. The NASDAQ and the CME have different trading hours. Trading of the Index constituents closes earlier than trading of the futures contracts, so there may continue to be price movements for the futures contracts when Index constituents are not trading.

• The trading price of the Units on the SEHK is driven by market factors such as the demand and supply of the Units. Therefore, the Units may trade at a substantial premium or discount to the NAV.

Product Details

Investment Objective

The investment objective of the Product is to provide Daily investment results, before fees and expenses, which closely correspond to twice (2x) the Daily performance of the NASDAQ-100 Index. The Product does not seek to achieve its stated investment objective over a period of time greater than one day.

Product Overview

| Asset Class | Futures |

| Listing Date | 28-Sep-2016 |

| Base Currency | USD |

| Net Asset Value (mil) | 12.59 |

| Manager | China Asset Management (HK) Limited |

| Domicile | Hong Kong |

| Management Fee | 0.99%(p.a.) |

| Trustee and Registrar | HSBC Institutional Trust Services (Asia) Limited |

| Distribution Policy | No regular distributions or dividends will be paid. The Manager may pay special dividends upon making an announcement in respect of the relevant distribution amount (in HKD only). |

As of 03-07-2025

Intra-day Estimated NAV and Market Price ( 2,3,4,5 )

Latest Market Information ( 4,6,7,8 )

| Date | Last | Change | Change(%) | |

|---|---|---|---|---|

| Official NAV per Unit in USD | 03-07-2025 | 4.6646 | 0.0877 | 1.92% |

| NAV per Unit in HKD (for reference only) | 03-07-2025 | 36.6169 | 0.6889 | 1.92% |

| Closing Price for HKD Traded Unit | 04-07-2025 | 36.2400 | 0.2800 | 0.78% |

Trading Information

| HKD Traded Units | ||

|---|---|---|

| Exchange Listing | SEHK – Main Board | |

| Commencement of Dealing | 28-Sep-2016 | |

| Stock Code | 7261 | |

| Trading Board Lot Size | 100 Units | |

| Trading Currency | HKD | |

| SEDOL Code | BYZTC03 | |

| Reuters Code | 7261.HK | |

| ISIN Code | HK0000306594 | |

| Bloomberg Ticker | 7261 HK | |

| Bloomberg NAV | 7261NAV | |

| Bloomberg iNAV | 7261IV | |

| Bloomberg Shares Outstanding | 7261SHO |

Index Information ( 9 )

| Index | NASDAQ-100 Index |

| Index Provider | NASDAQ |

| Currency | USD |

| Closing Level | 22866.97 |

| Change | 225.08 |

| Change (%) | 0.99% |

| Type of Index | Price Return |

As of 03-07-2025

Participating Dealers

- ABN AMRO Clearing Hong Kong Limited

- AP Capital Management (Hong Kong) Limited

- BNP Paribas

- China International Capital Corporation Hong Kong Securities Limited

- China Merchants Securities (HK) Co., Limited

- Citigroup Global Markets Asia Limited

- Credit Suisse Securities (Hong Kong) Limited

- DBS Vickers (Hong Kong) Limited

- Guotai Junan Securities (Hong Kong) Limited

- Haitong International Securities Company Limited

- KGI Asia Limited

- Korea Investment & Securities Asia Limited

- Merrill Lynch Far East Limited

- Mirae Asset Securities (HK) Limited

- Morgan Stanley Hong Kong Securities Limited

- UBS Securities Hong Kong Limited

- Yue Xiu Securities Company Limited

Market Makers

- Flow Traders Hong Kong Limited

- IMC Asia Pacific Limited

- Mirae Asset Securities (HK) Limited

Please refer to the Hong Kong Exchanges and Clearing Limited’s website at www.hkex.com.hk for the latest lists of Market Makers.

1 Data are provided by ICE Data Indices, LLC (“ICE DATA”), is used with permission. ICE DATA, its Affiliates and their respective third party suppliers (including but not limited to Factset Research System, Inc.) disclaim any and all warranties and representations, express and/or implied, including any warranties of merchantability or fitness for a particular purpose or use, including the index data and any data included in, related to, or derived therefrom. Neither ICE DATA, its Affiliates nor their respective third party suppliers shall be subject to any damages or liability with respect to the adequacy, accuracy, timeliness or completeness of the Index data or any component thereof, and the index data and all components therefore are provided on an “as is” basis and your use is at your own risk. ICE DATA, its Affiliates and their respective third party suppliers do not sponsor, endorse, or recommend China Asset Management (Hong Kong) Limited, or any of its products or services.

2 IOPV calculations are performed by ICE DATA.

3 Intra-day Market Price refers to the market price of ChinaAMC NASDAQ-100 Index Daily (2x) Leveraged Product on the date and at the time specified above, quoted from the Stock Exchange of Hong Kong Limited (the“SEHK”).

4 The exchange rate is not a real time exchange rate and is an assumed foreign exchange rate for reference only. The assumed foreign exchange rate is Reuters 3:00 p.m. Hong Kong time mid rate quoted by Interactive Data Real-Time FX Rate for USD:HKD.

5 The Intra-day Estimated NAV per Unit in HKD is indicative and for reference purposes only. It will be updated every 15 seconds. It is calculated by ICE Data Services using the intra-day Estimated NAV per unit in USD multiplied by the real time exchange rate provided by ICE Data Services. Since the Intra-day Estimated NAV per Unit in USD will not be updated when the CME is closed, any change in the Intra-day Estimated NAV per Unit in HKD (if any) during such period is solely due to the change in the assumed foreign exchange rate.

6 Change of the official NAV per Unit in USD and change of the NAV per Unit in HKD indicate the change of the NAV per Unit since previous Dealing Day^. Please refer to the Prospectus for more information on the determination of NAV.

7 Changes of the closing price for HKD traded Units indicate the change of the closing price since previous SEHK trading day. Source of Closing Price: Reuters.

8 The NAV per Unit in HKD is equivalent to the relevant official NAV per Unit in USD multiplied by the assumed foreign exchange rate of USD to HKD as mentioned in note 4 above as of the same Dealing Day^. The official NAV per Unit in USD and NAV per Unit in HKD will not be updated when the CME is closed.

9 Benchmark Index returns are for illustrative purposes only and are not indicative of future results. Benchmark Index returns do not reflect any management fees, transaction costs or expenses. Change indicates the change since the last closing index level. Source: NASDAQ, Bloomberg (see Terms and Conditions)

^ “Dealing Day” generally means a day on which (a) the SEHK and the underlying CME is open; and (b) the Index is compiled and published. Please refer to the Prospectus for further details in this regard.

Each existing unit in the Product is subdivided into 4 units with effect from 15 June 2020.

Returns/Historical NAVs Chart

Fund Price

| Class | Currency | Dealing Date | NAV per unit |

|---|---|---|---|

| USD | USD | 03-07-2025 | 4.6646 |

| HKD | HKD | 03-07-2025 | 36.6169 |

Since Launch Performance

Returns

USD

7 Day Annualized

Holdings

Overview

| Total Net Asset Value | Market Value of Futures Contracts | Futures Contract Exposure (b) |

|---|---|---|

| (Deemed Total Net Asset Value) (a) | ||

| 12,594,464.00 | 24,696,327.60 | 196.11% |

| (12,593,062.16) | ||

As of 03-07-2025

(a) Deemed Total Net Asset Value includes trading activities of (i) daily rebalancing; and (ii) creation and/or redemption orders of above date.

(b) Futures Contract Exposure = Market Value of Futures Contracts / Deemed Total Net Asset Value

Derivatives Counterparties

| Name | Gross Exposure | Net Exposure |

|---|---|---|

| BNP Paribus Securities Services | 196.11% | 196.11% |

As of 03-07-2025

Futures Contracts Holdings

| Futures Contracts Name | Bloomberg Ticker | Quantity |

|---|---|---|

| NASDAQ 100 E-MINI Sep 25 | NQU5 Index | 0 |

As of 03-07-2025

Product Holdings

| Holdings. | Weighting (%) |

|---|---|

| Cash and cash equivalents(USD) | 74.67 |

| CHIN SLT USD MM | 18.84 |

| UBS IRL SELECT MMKT USD-INSA MUTUAL FUND/LOAD | 4.29 |

| CHINAAMC SEL MM | 2.2 |

| Total | 100 |

As of 03-07-2025

Holdings are subject to change. Total allocation percentages shown in the Holdings table may not equal 100% due to rounding, omissions of non-stock portions, and the inclusion of the redemption payable from the stocks. The historical data provided herein is for reference only and does not represent any future performance.

Breakdown

As of 03-07-2025

Country Breakdown

As of 03-07-2025

Yield Information

There is currently no information available.

Asset Allocation

| Asset Typs | Weighting(%) |

|---|---|

| #N/A | 4.29% |

As of 03-07-2025

Tracking Difference & Error

Daily Tracking Difference (Daily TD):

Daily TD is the difference between the daily return of a Leveraged Product and the 2x daily performance of the underlying index.

Tracking Error (TE):

Tracking error measures how consistently a Leveraged Product delivers the 2x daily performance of the underlying index. It is the volatility (measured by standard deviation) of that daily return difference.

Tracking Difference / Tracking Error

| Actual average daily TD for calendar year 2017 | 0.01% |

| Actual average daily TD for calendar year 2018 | 0.02% |

| Actual average daily TD for calendar year 2019 | 0.02% |

| Actual average daily TD for calendar year 2020 | 0.01% |

| Actual average daily TD for calendar year 2021 | 0.01% |

| Actual average daily TD for calendar year 2022 | 0.01% |

| Actual average daily TD for calendar year 2023 | 0.03% |

| Actual average daily TD for calendar year 2024 | -0.04% |

| Rolling 1-year actual average daily TD# | -0.03% |

| Rolling 1-year Daily TE^ | 1.64% |

As of 30-06-2025

^TE is measured by the standard deviation of the daily TD. The standard deviation is calculated based on the daily TD over the rolling one year period.

# Rolling 1-Year TD is the rolling 1-year actual average daily tracking difference.

Graph (a) - Daily return of the Leveraged Product and the 2x daily performance of the underlying index

The Leveraged Product aims to deliver a daily return equivalent to two times of the underlying index return. For the purposes of calculating the Daily TD, the daily performance of the underlying index has been adjusted by the leverage factor of 2x.

Each existing unit in the Product is subdivided into 4 units with effect from 15 June 2020. The tracking difference of the Product and performance of the Product and its underlying index has been adjusted on 15 June 2020 to reflect the subdivision.

Graph (b) - Actual daily tracking difference

Each existing unit in the Product is subdivided into 4 units with effect from 15 June 2020. The tracking difference of the Product and performance of the Product and its underlying index has been adjusted on 15 June 2020 to reflect the subdivision.

Calendar Year Performance (#)

Past performance Vs Benchmark performance

| The Product | NASDAQ-100 Index | Leveraged (2x) of NASDAQ-100 Index | |

|---|---|---|---|

| 2024 | 38.2% | 25.9% | 51.8% |

| 2023 | 111.7% | 53.8% | 107.6% |

| 2022 | -60.51% | -32.97% | -65.94% |

| 2021 | 51.22% | 26.63% | 53.26% |

| 2020 | 89.14% | 47.58% | 95.16% |

| 2019 | 77.37% | 37.96% | 75.92% |

| 2018 | -11.65% | -1.04% | -2.08% |

| 2017 | 66.19% | 31.52% | 63.04% |

As of 31-12-2024

Note: With effect from 24 June 2024, the index methodology was updated to reflect certain changes in the eligibility requirements and the selection process for index constituents. The performance of the Product prior to 2024 was achieved under circumstances that no longer apply. With effect from 8 September 2021, Rafferty Asset Management LLC ceased to be the investment adviser of the Product. The performance of the Product prior to 2021 was achieved under circumstances that no longer apply. The investment strategy of the Product was also clarified that the scope of USD denominated investment products includes also other money market funds (either recognised jurisdiction money market funds or non-recognised jurisdiction money market funds) in accordance with the requirements of the Code on 22 March 2021.

Past performance information of the Product is not indicative of future performance. Investors may not get back the full amount invested. The computation basis of performance of the Product is based on the calendar year end, NAV-To-NAV, with dividend reinvested. The graph shows how much the Product and the underlying index increased or decreased in value during the calendar year being shown. Performance of the Product has been calculated in USD taking into account ongoing charges and excluding your trading costs on SEHK. The Product seeks to achieve its stated investment objective in one day and rebalances at the end of the day. That is, the performance of the Product may not correspond to two times the return of the underlying index over a one-year period or any period beyond one day. Investors should refer to the Prospectus for more information about the differences between the performance of the Product and two times the return of the underlying index over a period longer than one day. Where no past performance is shown there was insufficient data available in that year to provide performance.

Launch date: 26 September 2016

Distribution History

Prospectus & Documents

Financial Reports

Offering Documents

| File name | Date | File Format |

|---|---|---|

| 2024 Annual Report | 17-04-2025 | PDF > |

| Unaudited Semi-annual Report 2024 | 20-08-2024 | PDF > |

| 2023 Annual Report | 18-04-2024 | PDF > |

| Unaudited Semi-annual Report 2023 | 21-08-2023 | PDF > |

| 2022 Annual Report | 19-04-2023 | PDF > |

| Unaudited Semi-Annual Report 2022 | 22-08-2022 | PDF > |

| 2021 Annual Report | 20-04-2022 | PDF > |

| Unaudited Semi-annual Report 2021 | 23-08-2021 | PDF > |

| 2020 Annual Report | 21-04-2021 | PDF > |

| Unaudited Semi-annual Report 2020 | 21-08-2020 | PDF > |

| 2019 Annual Report | 21-04-2020 | PDF > |

| Unaudited Semi-annual Report 2019 | 22-08-2019 | PDF > |

| 2018 Annual Report | 24-04-2019 | PDF > |

| Unaudited Semi-annual Report 2018 | 23-08-2018 | PDF > |

| 2017 Annual Report | 27-04-2018 | PDF > |

| Unaudited Semi-annual Report 2017 | 06-12-2017 | PDF > |

| File name | Date | File Format |

|---|---|---|

| Product Key Facts | 25-04-2025 | PDF > |

| ChinaAMC Leveraged/Inverse Series Prospectus | 09-07-2024 | PDF > |

Announcements & Notices

FAQs

Leveraged Products typically aim to deliver a daily return equivalent to a multiple of the underlying index return. For example, if the underlying index rises by 10 per cent on a given day, two times (2x) the Leveraged Product should deliver a 20 per cent return on that day.

At or around the close of trading on the NASDAQ on each Business Day, the Product will seek to rebalance its portfolio, by increasing exposure in response to the Index’s Daily gains or reducing exposure in response to the Index’s Daily losses, so that its Daily leverage exposure ratio to the Index is consistent with the Product’s investment objective.

The table below illustrates how the Product as a leveraged product will rebalance its position following the movement of the Index by the end of the day.* Assuming that the initial Net Asset Value of the Product is 100 on Day 0, the Product will need to have an exposure of 200 to meet the objective of the Product. If the Index increases by 20% during the day, the Net Asset Value of the Product would have increased to 140, making the exposure of the Product 240. As the Product needs an futures exposure of 280, which is 2x the Product’s Net Asset Value at closing, the Product will need to rebalance its position by an additional 40.

Day 1 illustrates the rebalancing requirements if the Index falls by 10% on the subsequent day; Day 2 illustrates the rebalancing requirements if the Index rises by 10% on the subsequent day.

| Calculation | Day 0 | Day 1 | Day 2 | |

| (a) Initial Product NAV | 100.0 | 140.0 | 112.0 | |

| (b) Initial exposure | (b) = (a) x 2 | 200.0 | 280.0 | 224.0 |

| (c) Daily Index change (%) | 20% | -10% | 10% | |

| (d) Profit/loss on exposure | (d) = (b) x (c) | 40.0 | -28.0 | 22.40 |

| (e) Closing Product NAV | (e) = (a) + (d) | 140.0 | 112.0 | 134.40 |

| (f) Closing exposure before rebalancing | (f) = (b) x (1+ (c)) | 240.0 | 252.0 | 246.40 |

| (g) Target exposure to maintain leverage ratio |

(g) = (e) x 2 | 280.0 | 224.0 | 268.80 |

| (h) Required rebalancing amount | (h) = (g) – (f) | 40.0 | -28.0 | 22.40 |

* The above figures are calculated before fees and expenses.

A “roll” occurs when an existing E-mini NASDAQ 100 Future is about to expire and is replaced with an E-mini NASDAQ 100 Future representing the same underlying but with a later expiration date. The Manager has full discretion of futures rolling execution to meet the Product’s investment objective. The rolling of a E-mini NASDAQ 100 Future will occur on a single day within an 8-calendar day period in the last calendar month of each quarter (between 8 calendar days before the last trading day of the nearest quarterly E-mini NASDAQ 100 Futures and one business day before the last trading day of the nearest quarterly E-mini NASDAQ 100 Futures).

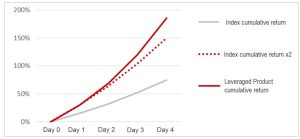

The objective of the Product is to provide investment results that, before fees and expenses, closely correspond to twice the performance of the Index on a Daily basis only. Therefore the Product should not be equated with seeking a leveraged position for periods longer than a day. The point-to-point performance of the Product over a period longer than one day may not be twice the performance of the Index over the same period of time due to the effect of “path dependency” and compounding of the Daily returns of the Index.

The performance of the Product before deduction of fees and expenses for periods longer than a single day, especially in periods of market volatility which has a negative impact on the cumulative return of the Product, may not be twice the return of the Index and may be completely uncorrelated to the extent of change of the Index over the same period.

The Product’s objective is to provide returns which are of a predetermined leverage factor (2x) of the Daily performance of the Index. The Product rebalances its portfolio on a Daily basis, increasing exposure in response to the Index’s Daily gains or reducing exposure in response to the Index’s Daily losses. This means that for a period longer than one Business Day, the pursuit of a Daily leveraged investment objective may result in Daily leveraged compounding for the Product. As such, the Product’s performance may not track twice the cumulative Index return over a period greater than 1 Business Day. This means that the return of the Index over a period of time greater than a single day multiplied by 200% generally will not equal the Product’s performance over that same period. Over time, the cumulative percentage increase or decrease in the value of the Product’s portfolio may diverge significantly from the cumulative percentage increase or decrease in of the return of the Index due to the compounding effect of losses and gains on the returns of the Product.

The following scenarios illustrate how the Product’s performance may deviate from that of the cumulative Index return (2x) over a longer period of time in various market conditions. All the scenarios are based on a hypothetical USD10 investment in the Product.

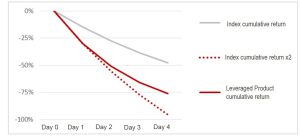

Scenario I: Continuous Upward Trend

In a continuous upward trend, where the Index rises steadily for more than 1 Business Day, the Product’s accumulated return will be greater than twice the cumulative Index gain. As illustrated in the scenario below, where an investor has invested in the Product on day 0 and the Index grows by 15% Daily for 4 Business Days, by day 4 the Product would have an accumulated gain of 185.61%, compared with a 149.80% gain which is twice the cumulative Index return..

| Index Daily return |

Index level |

Index cumulative return | Leveraged Product Daily return |

Leveraged Product NAV | Cumulative performance: Leveraged product | Cumulative performance: 2x of Index |

|

| Day 0 | 100.00 | 0.00% | USD 10.00 | 0.00% | 0.00% | ||

| Day 1 | 15.0% | 115.00 | 15.00% | 30.0% | USD 13.00 | 30.00% | 30.00% |

| Day 2 | 15.0% | 132.25 | 32.25% | 30.0% | USD 16.90 | 69.00% | 64.50% |

| Day 3 | 15.0% | 152.09 | 52.09% | 30.0% | USD 21.97 | 119.70% | 104.18% |

| Day 4 | 15.0% | 174.90 | 74.90% | 30.0% | USD 28.56 | 185.61% | 149.80% |

The chart below further illustrates the difference between (i) the Product’s performance; (ii) twice the cumulative Index return and (iii) cumulative Index return, in a continuous upward market trend over a period greater than 1 Business Day.

Scenario II: Continuous Downward Trend

In a continuous downward trend, where the Index falls steadily for more than 1 Business Day, the Product’s accumulated loss will be less than twice the cumulative Index loss. As illustrated in the scenario below, where an investor has invested in the Product on day 0 and the Index falls by 15% Daily for 4 Business Days, by day 4 the Product would have an accumulated loss of 75.99%, compared with a 95.60% loss which is twice the cumulative Index return.

| Index Daily return |

Index level |

Index cumulative return | Leveraged Product Daily return |

Leveraged Product NAV | Cumulative performance: Leveraged product | Cumulative performance: 2x of Index |

|

| Day 0 | 100.00 | 0.00% | USD 10.00 | 0.00% | 0.00% | ||

| Day 1 | -15.0% | 85.00 | -15.00% | -30.0% | USD 7.00 | -30.00% | -30.00% |

| Day 2 | -15.0% | 72.25 | -27.75% | -30.0% | USD 4.90 | -51.00% | -55.50% |

| Day 3 | -15.0% | 61.41 | -38.59% | -30.0% | USD 3.43 | -65.70% | -77.18% |

| Day 4 | -15.0% | 52.20 | -47.80% | -30.0% | USD 2.40 | -75.99% | -95.60% |

The chart below further illustrates the difference between (i) the Product’s performance; (ii) twice the cumulative Index return and (iii) cumulative Index return, in a continuous downward market trend over a period greater than 1 Business Day.

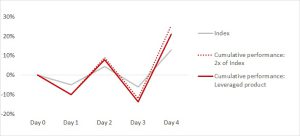

Scenario III: Volatile Upward Trend

In a volatile upward trend, where the Index generally moves upward over a period longer than 1 Business Day but with Daily volatility, the Product’s performance may be adversely affected in that the Product’s performance may fall short of twice the cumulative Index return. As illustrated in the scenario below, where the Index grows by 12.86% over 5 Business Days but with Daily volatility, the Product would have an accumulated gain of 20.96%, compared with a 25.72% gain which is twice the cumulative Index return.

| Index Daily return |

Index level |

Index cumulative return | Leveraged Product Daily return |

Leveraged Product NAV | Cumulative performance: Leveraged product | Cumulative performance: 2x of Index |

|

| Day 0 | 100.00 | 0.00% | USD 10.00 | 0.00% | 0.00% | ||

| Day 1 | -5.0% | 95.00 | -5.00% | -10.0% | USD 9.00 | -10.00% | -10.00% |

| Day 2 | 10.0% | 104.50 | 4.50% | 20.0% | USD 10.80 | 8.00% | 9.00% |

| Day 3 | -10.0% | 94.05 | -5.95% | -20.0% | USD 8.64 | -13.60% | -11.90% |

| Day 4 | 20.0% | 112.86 | 12.86% | 40.0% | USD 12.10 | 20.96% | 25.75% |

The chart below further illustrates the difference between (i) the Product’s performance; (ii) twice the cumulative Index return and (iii) cumulative Index return, in a volatile upward market trend over a period greater than 1 Business Day

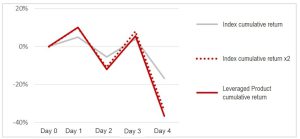

Scenario IV: Volatile Downward Trend

In a volatile downward trend, where the Index generally moves downward over a period longer than 1 Business Day but with Daily volatility, the Product’s performance may be adversely affected in that the Product’s performance may be more than twice the cumulative Index loss. As illustrated in the scenario below, where the Index falls by 16.84% over 5 Business Days but with Daily volatility, the Product would have an accumulated loss of 36.64%, compared with a 33.68% loss which is twice the cumulative Index return.

| Index Daily return |

Index level |

Index cumulative return | Leveraged Product Daily return |

Leveraged Product NAV | Cumulative performance: Leveraged product | Cumulative performance: 2x of Index |

|

| Day 0 | 100.00 | 0.00% | USD 10.00 | 0.00% | 0.00% | ||

| Day 1 | 5.0% | 105.00 | 5.00% | 10.0% | USD 11.00 | 10.00% | 10.00% |

| Day 2 | -10.0% | 94.50 | -5.50% | -20.0% | USD 8.80 | -12.00% | -11.00% |

| Day 3 | 10.0% | 103.95 | 3.95% | 20.0% | USD 10.56 | 5.60% | 7.90% |

| Day 4 | -20.0% | 83.16 | -16.84% | -40.0% | USD 6.34 | -36.64% | -33.68% |

The chart below further illustrates the difference between (i) the Product’s performance; (ii) twice the cumulative Index return and (iii) cumulative Index return, in a volatile downward market trend over a period greater than 1 Business Day.

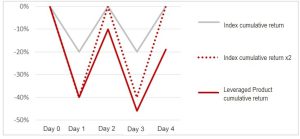

Scenario V: Volatile Market with Flat Index Performance

In a volatile market with flat index performance, the aforementioned compounding can have an adverse effect on the performance of the Product. As illustrated below, even if the Index has returned to its previous level, the Product may lose value.

| Index Daily return |

Index level |

Index cumulative return | Leveraged Product Daily return |

Leveraged Product NAV | Cumulative performance: Leveraged product | Cumulative performance: 2x of Index |

|

| Day 0 | 100.00 | 0.00% | USD 10.00 | 0.00% | 0.00% | ||

| Day 1 | -20.0% | 80.00 | -20.00% | -40.0% | USD 6.00 | -40.00% | -40.00% |

| Day 2 | 25.0% | 100.50 | 0.00% | 50.0% | USD 9.00 | -10.00% | 0.00% |

| Day 3 | -20.0% | 80.00 | -20.00% | -40.0% | USD 5.40 | -46.00% | -40.00% |

| Day 4 | 25.0% | 100.00 | 0.00% | 50.0% | USD 8.10 | -19.00% | 0.00% |

The chart below further illustrates the difference between (i) the Product’s performance; (ii) twice the cumulative Index return and (iii) cumulative Index return, in a volatile market with flat index performance over a period greater than 1 Business Day.

As illustrated in the graphs and the tables, the cumulative performance of the Product before deduction of fees and expenses is not equal to twice the cumulative performance of the Index over a period longer than 1 Business Day.

For further illustration of the Product’s performance under different market conditions, investors may access the ‘performance simulator’ on the Product’s website at http://liproduct.chinaamc.com.hk/HKen/7261, which will show the Product’s historical performance data during a selected time period since the launch of the Product.

The maximum potential loss when buying leveraged and inverse Products is the entire value of the initial investment. However, the maximum potential loss when investors trade futures could be greater than the initial collateral posted which would result in additional margin calls.

Performance Simulator

· Investors should understand that the Leveraged Product aims to provide returns closely correspond to twice (2x) the Daily performance of the Index. It has to rebalance its position on a daily basis in order to achieve its investment objective. As a result of rebalancing, it may not track the multiple return of the Index when it is held for less than a full trading day or overnight.

· Below is a performance simulator to allow investors to simulate the performance of the Leveraged Product during the selected period based on historical data. The investor is assumed to hold the Leveraged Product for the entire simulation period. The performance of the Leveraged Product is calculated based on it’s NAV. The performance of the Leveraged Product may not reflect the returns that the investor would be able to obtain as it does not capture the premium/ discount of the Leveraged Product, or the trading costs.

Performance Simulator

Please select the simulation period

Start date:

End date:

Simulation Results

The Product

0%

NASDAQ-100 Index (Price Return)

0%

Leveraged (2x) of NASDAQ-100 Index

0%

Performance Chart

Each existing unit in the Product is subdivided into 4 units with effect from 15 June 2020. The tracking difference of the Product and performance of the Product and its underlying index has been adjusted on 15 June 2020 to reflect the subdivision.

Product listing date: 28 September 2016. Where no past performance is shown, there was insufficient data available for that period to provide performance.

Source: China Assets Management (HK) Limited and Bloomberg.

The data presented above is for reference only and does not represent actual return.

Investing involves risk, including possible loss of principal. Investment in emerging market countries may involve heightened risks such as increased volatility and lower trading volume, and may be subject to a greater risk of loss than investment in a developed country. Please carefully consider the Fund’s investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the relevant Fund’s prospectus. Please read the prospectus carefully before investing. ChinaAMC Funds are not sponsored, endorsed, issued, sold or promoted by their index providers (only applicable to ETFs and index funds). For details of an index provider including any disclaimer, please refer to the relevant ChinaAMC Fund offering documents.

Source: Fund performance and index data are provided by ChinaAMC and the relevant index providers (if applicable) respectively.

This website is prepared by China Asset Management (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission.