Menu

Hong Kong-Listed ETFs

ChinaAMC Bitcoin ETF (3042 HK / 83042 HK / 9042 HK)

Management fee

0.99%(p.a.)

22892

Listing Date

30-Apr-2024

Morningstar

★★★★★ /5

Fund Performance

+15.3%

YTD

+72.87%

1 Year

-

3 Year

-

5 Year

+67.2%

Since Inception

As of 30-06-2025

Investment involves risks, including the loss of principal. Past performance is not indicative of future results. Before investing in the ChinaAMC Bitcoin ETF (the “Fund”), investor should refer to the Fund’s prospectus for details, including the risk factors. You should not make investment decision based on the information on this material alone. Please note:

• The Fund aims to provide investment results that, before fees and expenses, closely correspond to the performance of bitcoin, as measured by the performance of the CME CF Bitcoin Reference Rate (APAC Variant) (the “Index”).

• The Fund is passively managed and falls in the Index may cause falls in the value of the Fund. The Fund is subject to new product risk, new index risk, tracking error risk and trading risk with discount or premium.

• Due to the Fund’s direct exposure in bitcoin only, it is subject to concentration risk and risks related to bitcoin, such as bitcoin and bitcoin industry risk, speculative nature risk, unforeseeable risks, extreme price volatility risk, concentration of ownership risk, regulatory risk, fraud, market manipulation and security failure risk, cybersecurity risks, potential manipulation of bitcoin network risk, forks risk, risk of illicit use, trading hour difference risk.

• The Fund is subject to risks related to virtual asset trading platform (“VATP”), custody risks and risk relating to the difference between executable price of bitcoin on SFC-licensed VATPs and Index price for cash subscription and redemption.

• Listed and Unlisted Classes are subject to different pricing and dealing arrangements. NAV per Unit of each class may be different due to different fees and cost. Dealing deadlines of each class are different.

• Units of Listed Class are traded in the secondary market on an intraday basis at the prevailing market price, while Units of Unlisted Class are sold through intermediaries based on the dealing day-end NAV. Investors of Unlisted Class could redeem at NAV while investors of Listed Class in the secondary market could only sell at the prevailing market price and may have to exit the Fund at a significant discount. Investors of Unlisted Class may be at an advantage or disadvantage compared to investors of Listed Class.

• The Fund is subject to multi-counter risks.

Please note the above list of risks is not exhaustive, please refer to the Fund’s prospectus for details.

Product Details

Investment Objective

The investment objective is to provide investment results that, before fees and expenses, closely correspond to the performance of bitcoin, as measured by the performance of the CME CF Bitcoin Reference Rate (APAC Variant).

Product Overview

| Asset Class | Virtual asset |

| Listing Date | 30-Apr-2024 |

| Base Currency | USD |

| Net Asset Value (mil) | 247.04 |

| Domicile | Hong Kong |

| Management Fee | 0.99%(p.a.) |

| Custodian | BOCI-Prudential Trustee Limited |

| Sub-Custodian | OSL Digital Securities Limited, acting via its associated entity BC Business Management Services (HK) Limited |

| Distribution Policy | No distribution will be made to Shareholders |

| Virtual Asset Trading Platform | OSL Exchange (operated by OSL Digital Securities Limited) |

As of 10-07-2025

Intra-day Estimated NAV and Market Price ( 1,2,3,4 )

Latest Market Information ( 5,6 )

| Date | Last | Change | Change(%) | |

|---|---|---|---|---|

| Official NAV per Unit in USD | 10-07-2025 | 1.7557 | 0.0404 | 2.36% |

| NAV per Unit in RMB (for reference only) | 10-07-2025 | 12.6047 | 0.2791 | 2.26% |

| NAV per Unit in HKD (for reference only) | 10-07-2025 | 13.7822 | 0.3173 | 2.36% |

| Closing Price for USD Traded Unit | 10-07-2025 | 1.7560 | 0.0440 | 2.57% |

| Closing Price for RMB Traded Unit | 10-07-2025 | 12.5900 | 0.2800 | 2.27% |

| Closing Price for HKD Traded Unit | 10-07-2025 | 13.7900 | 0.3100 | 2.30% |

Trading Information

| HKD Traded Units | RMB Traded Units | USD Traded Units | ||

|---|---|---|---|---|

| Exchange Listing | SEHK – Main Board | SEHK – Main Board | SEHK – Main Board | |

| Listing Date | 30-Apr-2024 | 30-Apr-2024 | 30-Apr-2024 | |

| Stock Code | 3042 | 83042 | 9042 | |

| Trading Board Lot Size | 100 Shares | 100 Shares | 100 Shares | |

| Trading Currency | HKD | RMB | USD | |

| Reuters Code | 3042.HK | 83042.HK | 9042.HK | |

| ISIN Code | HK0001009700 | HK0001009700 | HK0001009700 | |

| Bloomberg Ticker | 3042 HK | 83042 HK | 9042 HK | |

| Bloomberg NAV | 3042NAV | 83042NAV | 9042NAV | |

| Bloomberg iNAV | 3042IV | 83042IV | 9042IV | |

| Bloomberg Shares Outstanding | 3042SHO | 83042SHO | 9042SHO |

Index Information ( 7 )

| Index | CME CF Bitcoin Reference Rate (APAC Variant) |

| Index Provider | CF Benchmarks Ltd. |

| Currency | USD |

| Closing Level | 111357.5 |

| Change | 2571.5 |

| Change (%) | 2.36% |

| Type of Index | Price Return |

As of 10-07-2025

Participating Dealers

- Both In Kind and In Cash

- Eddid Securities and Futures Limited

- Fosun International Securities Limited

- Solomon JFZ (Asia) Holdings Limited

- Victory Securities Company Limited

- Only In Cash

- AP Capital Management (Hong Kong) Limited

- Arta Global Markets Limited

- China Merchants Securities (HK) Co., Limited

- DL Securities (HK) Limited

- Futu Securities International (Hong Kong) Limited

- Haitong International Securities Company Limited

- Huatai Financial Holdings (Hong Kong) Limited

- Korea Investment & Securities Asia Limited

- Mirae Asset Securities (HK) Limited

- Valuable Capital Limited

Market Makers

| HKD Counter | RMB Counter | USD Counter |

|---|---|---|

| CLSA Limited | CLSA Limited | CLSA Limited |

| Jane Street Asia Trading Limited | Jane Street Asia Trading Limited | Jane Street Asia Trading Limited |

| Optiver Trading Hong Kong Limited | Optiver Trading Hong Kong Limited | Optiver Trading Hong Kong Limited |

| Virtu Financial Singapore PTE. Ltd. | Virtu Financial Singapore PTE. Ltd. | Virtu Financial Singapore PTE. Ltd. |

| Eclipse Options (HK) Ltd | ||

| Flow Traders Hong Kong Limited |

Please refer to the Hong Kong Exchanges and Clearing Limited’s website at www.hkex.com.hk for the latest lists of Market Makers.

1 Data are provided by ICE Data Indices, LLC (“ICE DATA”), is used with permission. ICE DATA, its Affiliates and their respective third-party suppliers (including but not limited to Factset Research System, Inc.) disclaim any and all warranties and representations, express and/or implied, including any warranties of merchantability or fitness for a particular purpose or use, including the index data and any data included in, related to, or derived therefrom. Neither ICE DATA, its Affiliates nor their respective third-party suppliers shall be subject to any damages or liability with respect to the adequacy, accuracy, timeliness or completeness of the Index data or any component thereof, and the index data and all components therefore are provided on an “as is” basis and your use is at your own risk. ICE DATA, its Affiliates and their respective third-party suppliers do not sponsor, endorse, or recommend China Asset Management (Hong Kong) Limited, or any of its products or services.

2 IOPV calculations are performed by ICE DATA.

3 Intra-day Market Price refers to the market price of ChinaAMC Bitcoin ETF on the date and at the time specified above, quoted from the Stock Exchange of Hong Kong Limited (the “SEHK”).

4 The Intra-day Estimated NAV per Unit is updated during SEHK trading hours and is for reference only. The Intra-day Estimated NAV per Unit in RMD and HKD is calculated using the Intra-day Estimated NAV per Unit in USD multiplied by the real time exchange rate provided by ICE DATA. Since the Intra-day Estimated NAV per Unit in USD will not be updated when the underlying share market is closed, the change in the Intra-day Estimated NAV per unit in RMB or HKD (if any) during such period is solely due to the change in the foreign exchange rate.

5 The last NAV per Share in RMB and HKD is calculated using the official last NAV per Share in USD multiplied by an assumed foreign exchange rate using the USD exchange rate quoted by Bloomberg at 4:00 p.m. (Hong Kong time) as of the same Dealing Day. The last NAV per Unit will be updated on days when the SEHK is open for trading. Changes of the official last NAV per Unit in USD and last change of the NAV per Unit in RMB and HKD indicate the change of the NAV per Unit since previous Dealing Day^. Please refer to the Prospectus for more information on the determination of NAV.

6 Changes of the closing price for HKD, RMB and USD Traded Units indicate the change of the closing price since previous SEHK trading day. Source of Closing Price: Bloomberg.

7 Index returns are for illustrative purposes only and are not indicative of future results. Index returns do not reflect any management fees, transaction costs or expenses. Change indicates the change since the last closing index level. Source: CF Benchmarks, Bloomberg.

^ “Dealing Day” generally means a day on which (a) the SEHK and the underlying A shares market are open; and (b) the Index is compiled and published. Please refer to the Prospectus for further details in this regard.

Returns/Historical NAVs Chart

Fund Price

| Class | Currency | Dealing Date | NAV per unit |

|---|---|---|---|

| USD | USD | 10-07-2025 | 1.7557 |

| RMB | RMB | 10-07-2025 | 12.6047 |

| HKD | HKD | 10-07-2025 | 13.7822 |

Returns

Historical NAVs

USD

USD

Investment involves risks. Past performance information is not indicative of future performance. Investors may not get back the full amount invested. The computation basis of the performance is based on the calendar year end, NAV-to-NAV, with dividend reinvested. These figures show by how much the Fund increased or decreased in value during the calendar year being shown. Performance data has been calculated in the base currency of the share class (or the ETF), including ongoing charges and excluding subscription and redemption fees and trading costs on SEHK (if applicable). Where no past performance is shown there was insufficient data available in that year to provide performance. Please refer to the Fund Overview section for the inception date of the share class (or the listing date of the ETF).

7 Day Annualized

Holdings

Overview

| Holdings. | Weighting (%) |

|---|---|

| VA BITCOIN CURRENCY | 99.98 |

| Total | 99.98 |

As of 10-07-2025

Holdings are subject to change. Total allocation percentages shown in the Holdings table may not equal 100% due to rounding, The historical data provided herein is for reference only and does not represent any future performance.

As of 10-07-2025

As of 10-07-2025

Yield Information

There is currently no information available.

Asset Allocation

| Asset Typs | Weighting(%) |

|---|

As of 10-07-2025

Tracking Difference & Error

Tracking Difference (TD):

Tracking difference is the return difference between the ETF and its underlying benchmark/ index over a certain period of time.

Tracking Error (TE):

Tracking error measures how consistently the ETF follows its benchmark/ index. It is the volatility (measured by standard deviation) of that return difference.

Tracking Difference / Tracking Error

| Rolling 1-Year TD | -2.48% |

| Rolling 1-Year TE^ | 0.08% |

As of 30-06-2025

Graph for Tracking Difference

Calendar Year Performance (#)

| The Fund | Index(Price Return) | Index(Total Return) |

|---|

As of 31-12-2024

Past performance Vs Benchmark performance

ETF listing date: 30 April 2024

Investment involves risks. Past performance information is not indicative of future performance. Investors may not get back the full amount invested. The computation basis of the performance is based on the calendar year end, NAV-to-NAV, with dividend reinvested. These figures show by how much the Fund increased or decreased in value during the calendar year being shown. Performance data has been calculated in the base currency of the share class (or the ETF), including ongoing charges and excluding subscription and redemption fees and trading costs on SEHK (if applicable). Where no past performance is shown there was insufficient data available in that year to provide performance. Please refer to the Fund Overview section for the inception date of the share class (or the listing date of the ETF).

Distribution History

Distribution History

*“Net distributable income” means the net investment income (i.e. dividend income and interest income net of fees and expenses) attributable to the relevant share class and includes net realised gains (if any) based on unaudited management accounts. However, “net distributable income” does not include net unrealised gains.

The distribution paid will be at the discretion of the Manager. Distribution figures shown are past distributions declared and paid for by the Fund.

Warning: Please note that a positive distribution yield does not imply a positive return. Investors should not make any investment decision solely based on information contained in the table above. There is no guarantee of distribution. Investors should read the relevant offering document (including the key facts statement) of the fund for further details including the risk factors. Distributions will be paid in Base Currency only. Unitholders may have to bear the fees and charges associated with the conversion of such distributions from HKD to USD or any other currency.

Prospectus & Documents

Factsheet

Financial Reports

Offering Documents

| File name | Date | File Format |

|---|---|---|

| Factsheet - May 2025 | 30-05-2025 | PDF > |

| Factsheet - April 2025 | 30-04-2025 | PDF > |

| Factsheet - March 2025 | 31-03-2025 | PDF > |

| Factsheet - February 2025 | 28-02-2025 | PDF > |

| Factsheet - January 2025 | 28-01-2025 | PDF > |

| Factsheet - December 2024 | 31-12-2024 | PDF > |

| Factsheet - November 2024 | 29-11-2024 | PDF > |

| Factsheet - October 2024 | 31-10-2024 | PDF > |

| File name | Date | File Format |

|---|---|---|

| 2024 Annual Report | 30-04-2025 | PDF > |

| File name | Date | File Format |

|---|---|---|

| Prospectus | 15-05-2025 | PDF > |

| Product Key Facts | 15-05-2025 | PDF > |

Announcements & Notices

FAQs

A cryptocurrency is a digital or virtual currency based on cryptographic principles. It uses encryption technology to secure transactions, generate new coins, and verify fund transfers. A key characteristic of cryptocurrencies is their decentralization, meaning they are not controlled by any central agency or government.

Cryptocurrencies operate on a blockchain, a distributed public ledger which serves as a record of all transactions updated and maintained by currency holders. Units of cryptocurrency are created through a process known as mining, which involves using computer power to solve complex mathematical problems that result in the production of coins.

(1) Blockchain technology

It is a decentralized public ledger or a list of cryptocurrency transactions. Completed blocks, consisting of the most recent transactions, are recorded and added to the blockchain in a chronological and verifiable manner. All records are permanent and open to public. The blockchain is managed by market participants through a peer-to-peer network, following a set protocol for validating new blocks. Every connected node or computer automatically downloads a copy of the blockchain, allowing transparent transaction tracking without the need for central record-keeping.

(2) Block mining

It refers to the process of adding a new transaction record to the blockchain as a block. For certain cryptocurrencies like Bitcoin, the mining process would generate new coins, increasing the total number in circulation. Mining requires specific software to solve mathematical puzzles and verify legitimate transactions within a block. These blocks are added to the public ledger (blockchain) approximately every 10 minutes.

(1) Decentralization: Cryptocurrencies operate without a central authority, relying on a group of users for maintenance and governance.

(2) Security: Cryptocurrencies employ advanced cryptographic algorithms to protect transactions and control coin generation, making them more resistant to counterfeiting or tampering compared to traditional currencies.

(3) Anonymity: While all transactions are recorded on a public ledger, a user can maintain anonymity by using one or a set of encrypted addresses.

(4) Global Reach: Cryptocurrencies can be used for cross-border transactions, enabling users to send and receive funds anywhere in the world without relying on traditional banking systems.

A cryptocurrency exchange serves as a platform for buying, selling, and exchanging various cryptocurrencies. These platforms typically facilitate the trading of different digital currencies, determine prices based on market demand and popularity, and charge transaction fees as a percentage of the trade value.

Bitcoin was created in 2009 by an anonymous developer or group of anonymous developers under the name of Satoshi Nakamoto. Bitcoin is a decentralized cryptocurrency that operates on a peer-to-peer network and utilizes a consensus mechanism. It is open source and uses blockchain technology as its underlying infrastructure.

The total market capitalization of the cryptocurrency market has exceeded $2.53 trillion since 2024, with Bitcoin, the largest cryptocurrency, experiencing a more than 69% increase in the first quarter of the year. The rise is driven by spot Bitcoin ETFs, which attracted over $12 billion of inflows in the first quarter. Currently, the spot Bitcoin ETFs hold a total of 831,000 bitcoins, with a value of around $59 billion.

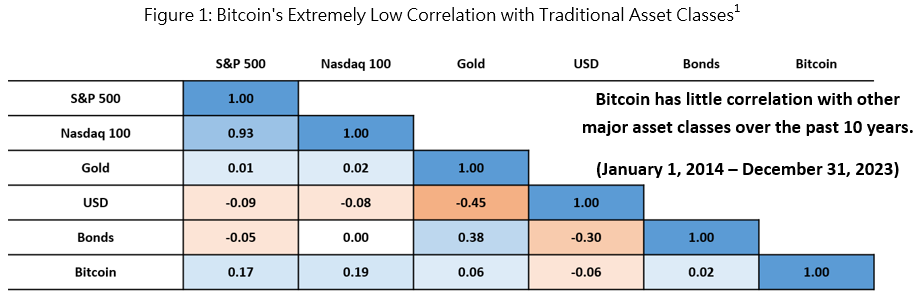

Enhancing Portfolio Diversification

Bitcoin’s low correlation with mainstream financial markets makes it an effective tool for diversifying investment portfolios. Meanwhile, as Bitcoin gains wider acceptance and institutional investors incorporate it into their portfolios, its higher risk profile is expected to contribute to better portfolio performance.

[1] Statistical period: January 1, 2014, to December 31, 2023.

Source: Bloomberg, as of 31 December 2023. The four hypothetical portfolios shown are comprised of the following asset class representative benchmarks: Stocks as represented by the S&P 500 Index, Bonds as represented by the Bloomberg US Aggregate Bond Index, and Bitcoin as represented by the S&P Bitcoin Index. Bonds in the asset class table on the top are also represented by the Bloomberg US Aggregate Bond Index.

Similar to gold ETFs, spot Bitcoin ETFs are exchange-listed investment funds that enable indirect investments in Bitcoin without purchasing or holding the cryptocurrency.

Bitcoin ETFs are issued and managed by fund companies, listed on traditional stock exchanges, and invested in Bitcoin according to the ETF’s investment objectives and strategies. They aim to provide investors with investment returns that closely track the performance of a Bitcoin index (gross of fees and expenses).

(1) Secure transactions

Regulated spot Bitcoin ETFs listed on the Hong Kong Stock Exchange offer reduced risks of hacking and fraud due to the involvement of professional fund managers and reputable custodians. This eliminates the need for investors to protect private keys and manage wallets.

(2) Simple and convenient transactions

Spot ETFs can be bought and held through traditional stock accounts, similar to stocks, without requiring a dedicated cryptocurrency trading account.

(3) Low investment threshold

ETFs generally have a lower investment threshold, often starting at $100.

(4) Dual liquidity

Bitcoin, being the largest cryptocurrency in the world, serves as highly liquid underlying assets. The listing of spot ETFs on traditional exchanges further enhances liquidity.

(5) Regulated and legal assets

Bitcoin ETFs are legal investment products approved by Hong Kong regulators, with a reduced level of trading associated regulatory risks[2].

[2] Authorization of a fund product by the SFC does not imply a recommendation or endorsement by the SFC of Hong Kong, nor does it guarantee the commercial merits or performance of the fund product.

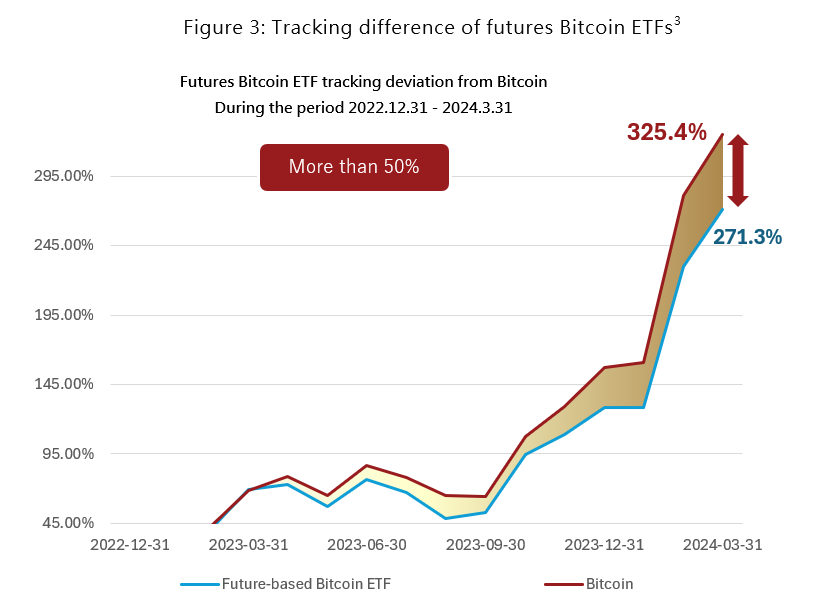

Futures cryptocurrency contracts are a more complex investment tool that requires a higher level of professional knowledge from investors. The performance of a futures cryptocurrency ETF may not precisely reflect that of a spot cryptocurrency due to certain tracking errors.

On the other hand, spot ETFs are more straightforward and easier to understand. They closely track the performance of cryptocurrencies such as Bitcoin and Ethereum, making them accessible to a wider group of investors. The advantages of spot ETFs include:

(1) Direct tracking of Bitcoin

Spot Bitcoin ETFs directly track the price of Bitcoin, rather than through futures contracts. They allow investors to gain more direct exposure to the price movements of these assets, without concerns about the potential risks associated with futures contracts.

(2) Exemption from expensive rolling costs

Futures ETFs typically incur higher transaction costs due to the management of futures contracts. In contrast, Spot ETFs have a simpler fee structure, often involving only management fees. This makes holding a spot ETF for the long term generally more cost-effective.

(3) Lower tracking error

Futures crypto ETFs require regular rollovers, which can lead to rollover costs, especially in situations where the futures price exceeds the spot price (known as contango).

[3] The data is based on the return of one of the Bitcoin futures ETFs listed on the Hong Kong Stock Exchange compared with the return of Bitcoin and is for reference only. It does not represent the return performance of all Bitcoin futures ETFs listed on the Hong Kong Exchange.

Source: Bloomberg, date as of March 31, 2024.

(1) Time zone

Compared with the United States, local investors in Hong Kong can avoid the inconvenience and risks that may arise from cross-time zone trading.

(2) Innovative subscription and redemption arrangement, allowing both in-cash and in-kind transactions

Surpassing the United States, Hong Kong has introduced an innovative subscription and redemption mechanism that allows investors to choose between subscribing and redeeming ETFs in cash or in kind (physical cryptocurrency).

(3) Tax incentives

Hong Kong residents can enjoy tax benefits when purchasing spot Bitcoin ETFs in Hong Kong, sparing them relevant taxes. In contrast, investing in a U.S. spot Bitcoin ETF may involve additional taxes.

(4) Available to Hong Kong retail investors

Hong Kong investors can purchase Hong Kong’s spot Bitcoin ETFs mainly by completing a cryptocurrency knowledge test, in addition to meeting basic Know Your Customer (KYC) requirements. In contrast, Hong Kong investors purchasing the corresponding ETF in the United States must be professional investors who meet high investment threshold restrictions.

The cryptocurrency knowledge test consists of the following items:

(1) Completion of virtual asset-related training.

(2) Work experience in virtual asset-related fields.

(3) Prior trading experience of virtual assets.

If a customer fulfils any of the above three requirements, they are considered to have passed the test. In case retail investors fail to meet these criteria, intermediaries can provide relevant training to investors before facilitating transactions on their behalf.

Investment involves risks, including the loss of principle. Past performance is not indicative of future results. Before investing in spot bitcoin ETFs investors should refer to the Fund’s prospectus for details, including the risk factors. You should not make investment decisions based on the information on this material alone. Please note:

• Spot Bitcoin ETFs are passively managed and falls in the Index may cause falls in the value of the Fund. Spot Bitcoin ETFs are subject to new product risk, new index risk, tracking error risk and trading risk with discount or premium.

• Due to the Spot Bitcoin ETFs’direct exposure in bitcoin only, they are subject to concentration risk and risks related to bitcoin, such as bitcoin and bitcoin industry risk, speculative nature risk, unforeseeable risks, extreme price volatility risk, concentration of ownership risk, regulatory risk, fraud, market manipulation and security failure risk, cybersecurity risks, potential manipulation of bitcoin network risk, forks risk, risk of illicit use, trading hour difference risk.

• Spot Bitcoin ETFs are subject to risks related to virtual asset trading platform (“VATP”), custody risks and risks relating to the difference between executable price of bitcoin on SFC-licensed VATPs and Index price for cash subscription and redemption.

Please note the above list of risks is not exhaustive, please refer to the Fund’s prospectus for details.

Investing involves risk, including possible loss of principal. Investment in emerging market countries may involve heightened risks such as increased volatility and lower trading volume, and may be subject to a greater risk of loss than investment in a developed country. Please carefully consider the Fund’s investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the relevant Fund’s prospectus. Please read the prospectus carefully before investing. ChinaAMC Funds are not sponsored, endorsed, issued, sold or promoted by their index providers (only applicable to ETFs and index funds). For details of an index provider including any disclaimer, please refer to the relevant ChinaAMC Fund offering documents.

Source: Fund performance and index data are provided by ChinaAMC and the relevant index providers (if applicable) respectively.

This website is prepared by China Asset Management (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission.

Performance Simulator

Performance Simulator

Please select the simulation period

Start date:

End date:

Simulation Results

The Product

0%

Index

0%

Leverage/Inverse

0%

Performance Chart

Remarks

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu.Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu.